According to a January 3, 2008 article in the on-line edition of the Economist, oil is becoming more and more expensive, but not because the world is running out of oil reserves.

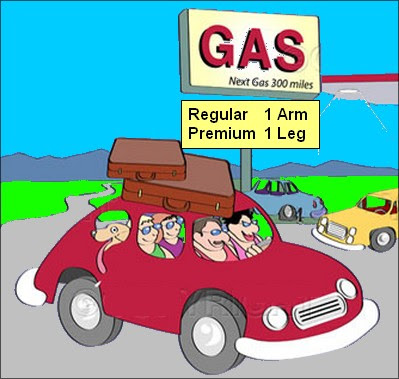

According to a January 3, 2008 article in the on-line edition of the Economist, oil is becoming more and more expensive, but not because the world is running out of oil reserves.I suspect that most Canadians (or Americans) will not be surprised by this earth shattering little piece of news. Anyone who drives an automobile has likely noticed the impact on their wallet, or at least the contents thereof, every time they tell some gas jockey to “fill’er up”. I don’t believe the rumours that some people are taking out second mortgages on their homes or forcing their wives to stand on street corners just to keep their SUVs on the road. But, the cost of gasoline is definitely going up.

A layman like myself might be misled into believing it was the old economic theory of supply and demand that caused the price of oil to jump to $100.00 per barrel; a five-fold increase since 2002. As the economies of India and China grow and become more heavily industrialized, they place a greater demand on available supplies of the black gold. Not so says the Economist. Increased demand is only a small contributing factor.

Another underlying factor, apparently, is that back in the 1980’s and 1990’s, when the price of oil was very low, the big oil firms stopped investment in research, development and exploration, laying off people and shutting down operations to increase short term profit. And, now that they need increased production capacity they simply don’t have the staff and equipment they need to get the job done.

The Economist notes that “political tension” in the Middle East also creates uncertainty in the market causing oil prices to rise dramatically. Maybe they could talk their buddy, George Bush, into not bombing the shit out of everybody over there. Is it merely a coincidence that the skyrocketing price of oil coincided with Bush’s “pre-emptive strike” against Iraq? That the cost continues to rise while he rattles the saber at Iran?

No, the biggest impediment to stable oil prices, says the Economist, is political. Governments in almost all oil-rich countries, from Ecuador to Kazakhstan, “often deter private investment or exclude it altogether.” According to the Economist, “The world's oil supply would increase markedly if Exxon Mobil and Royal Dutch Shell had freer access to (the oil supplies of) Russia, Venezuela and Iran.” Of course, that would also deplete the worlds oil reserves that much quicker.

Note that they didn’t mention Iraq, with the second largest conventional oil reserves in the world after Saudi Arabia. Or even Saudi Arabia. Is it that both these countries are now firmly under control of the United States? But, they did mention Iran, the next target of America’s military juggernaut, if George Bush has his way; and the location of the third largest reserves of oil in the world.

But, if the Yanks want to secure the world’s oil reserves for American industry, why should we care? Canada is self-sufficient.

We should care because the article in the Economist also points out that the Alberta tar sands hold almost as much oil as Saudi Arabia. And, the tar sands are not included in the known reserves of conventional oil because of the high cost of extracting it. Otherwise, Canada would be ranked number two in the world instead of Iraq.

But, at $100.00 a barrel, the cost of extracting crude from the tar sands is no longer seen as an economic deterrence to exploitation of that resource. That’s a scary thought. Really. If the Yanks decide to invade Alberta, where will all the Newfies and Cape Bretoners find work?

Maybe Canadians should not leave the longest undefended border in the world undefended; at least as long as Mr. Bush is in charge.

No comments:

Post a Comment